The tax rate depends on whether the buyer is charged the exact cost of the shipment, or if the seller is using flat rate shipping or other methods that involve marking up the shipping cost. You will need to let us know which method you use so we can collect the correct amount of tax on your orders. This information will not be shared with buyers.

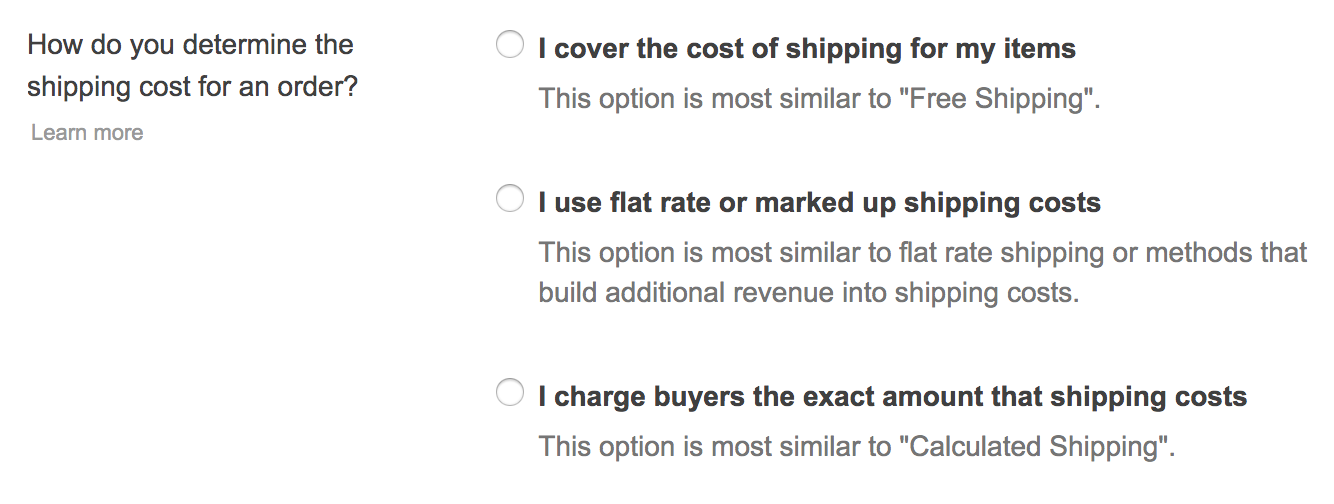

There are three options to choose from:

-

I cover the cost of shipping for my items

- This is most similar to Free Shipping

-

I use flat rate or marked up shipping costs

- This is most similar to Flat Rate Shipping

-

I charge buyers the exact amount that shipping costs

- This is most similar to Calculated Shipping

You can only select one option. If you offer multiple shipping methods or use different shipping methods for different items, we recommend selecting the option that best aligns with how you most often set shipping prices. If you are unsure which of the available options is best for your business, we recommend consulting with a tax professional.

You can add or edit that setting in your booth settings. Be sure to save any changes you make.

What happens if I do not complete the required actions?

If a seller does not complete the reauthorization steps outlined above by September 4, 2019, Bonanza will add the estimated tax to the order total when the buyer is located in AL, AZ, AR, CA, CO, HI, IL, IN, IA, KS, KY, ME, MD, MN, NE, NV, NJ, NC, ND, OH, OK, PA, RI, TN, TX, UT, VT, WA, WV, WI or WY. The buyer will pay the tax to the seller, then Bonanza will bill the seller for the amount of the tax. The charge will be reflected as a “Tax” line item on your billing statement. Bonanza will charge the seller’s card on file for the tax due once per day. Bonanza will then remit the tax to the appropriate government agencies.

What happens if the buyer is refunded?

If the buyer is refunded and Bonanza collected the sales tax, Bonanza will refund the sales tax portion of the order total back to the buyer. If the buyer receives a partial refund, Bonanza will refund a proportional percentage of the sales tax back to the buyer.

How is this different from how Bonanza has handled sales tax in the past?

Until these changes were enacted, Bonanza as a marketplace did not collect sales tax. Sellers had an option to set up sales tax rules in the Payments & Purchases tab of their booth, but we’ve always left it up to the seller to determine which tax rules apply to their business. Sellers were then responsible for remitting the tax funds to the relevant state.

Full article here: